Crypto Loan, a New Craze After NFT

Overview

Despite the first NFT created back in 2014, its mainstream awareness happened a few years later, in 2017. In Q1 2021, NFT rising was undoubtedly one of the year's biggest highlights and found its use in many fields such as art, video gaming, and real estate.

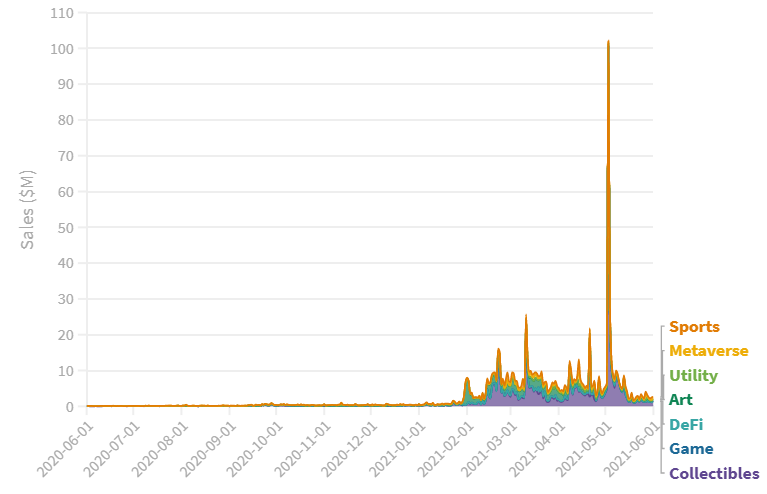

NFT stands for Non-Fungible Token, a unique digital asset used to record the ownership of various types of data such as audio and video files. According to Protos, NFT hype peaked on May 3 with $102M worth of assets sold in just one day.

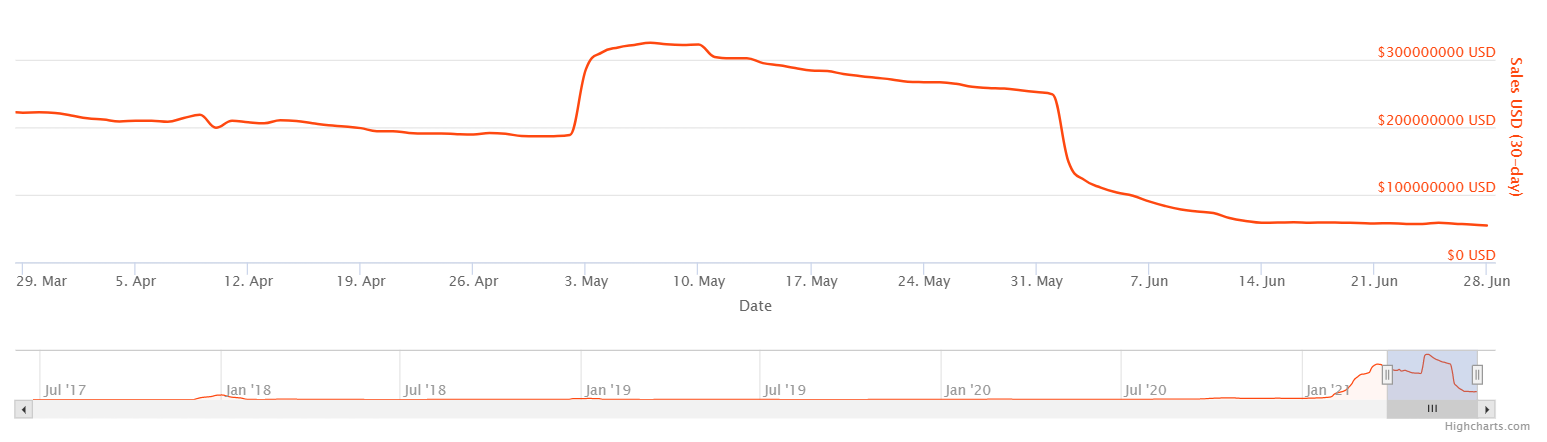

Straight after, the market dropped and since then continues to do so. NonFungible chart uncovers these dramatic changes - in May, sales numbers stayed more or less stable before dropping in June.

Despite dips, the NFT market is projected to grow tremendously. Just recently, the notion of using NFT as collateral for taking out crypto loans has been gaining traction, and rightly so. Crypto lending offers more for NFT than one can imagine - just like art masterpieces in the real world, they can become very valuable exchange assets in crypto land.

Crypto lending is something that might revolutionize the digital art and finance industry, providing higher returns and better terms. Read here to learn more about crypto loans and how you can take advantage of them.

Crypto Loans vs. Conventional Lending

Even though it might seem like something very complex, it's not that difficult to understand. Crypto loans are essentially similar to bank loans (meaning there's also a borrower and a lender) but have some specific characteristics.

These are the main differences between crypto and traditional loans:

- A standard loan involves a bank (a bank either acts as the lender or functions as a mediator between borrower and lender), while crypto lending platforms don't use banks as the third party.

- There is no need to submit credit history checks to get a crypto loan.

How Crypto Loans Work

Imagine you have 5 BTC. Then, you have two options: either sell your assets and get money or wait until (or if) the BTC price goes up and only then sell it, earning more money. Both decisions have their cons: in the first case, you can get less money, while in the second, the asset's price might never rise.

However, thanks to crypto loans, there's a third way - a crypto loan. That 5 BTC you have can become collateral. However, the loan amount depends on LTV. For instance, if LTV is 50%, you will be able to get 2,5 BTC (50% of collateral) equivalent in whatever currency you choose. The higher the loan's LTV, the riskier it is.

You got the loan. What's next? If the collateral's price skyrockets, then you are lucky and can immediately use collateral to repay the loan and make a profit. That's the perfect scenario every crypto borrower hopes happens to them and the main reason users get crypto loans in the first place.

But there's also a less encouraging scenario: BTC price falls, meaning the loan possesses higher risk. There are two options: either everything goes back to normal, i.e., BTC price stabilizes, or the asset's price keeps falling. In that case, you will have to use the collateral to repay the loan ASAP to prevent collateral liquidation, which happens when the market experiences a dip.

So you see, the profit you can make off a crypto loan lies in the market volatility itself. Sure, that makes crypto loans, in general, riskier than bank ones, but at the same time, crypto lending can increase your gains.

One of the significant advantages of crypto loans compared to traditional banking is that lending is more accessible (e.g., for people without a financial history, underbanked consumers, self-employed workers) and instant.

Traditional Banking vs. Crypto Lending Loan Rates

According to DeFiRate, interest rates on crypto lending platforms vary.

Depending on the cryptocurrency, numbers can differ dramatically. For instance, BTC can have different rates, with the maximum rate being 16.12% and the minimum one being 0.66%.

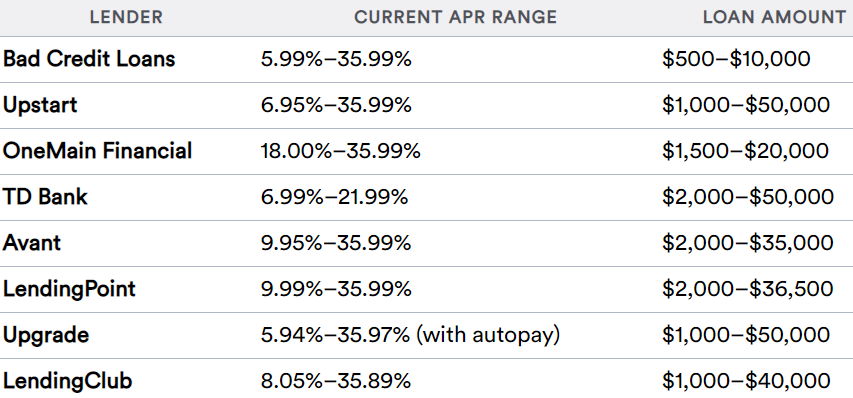

In traditional banking, it all comes down to credit history. For example, according to BankRate, borrowers with bad credit history can expect APR like these:

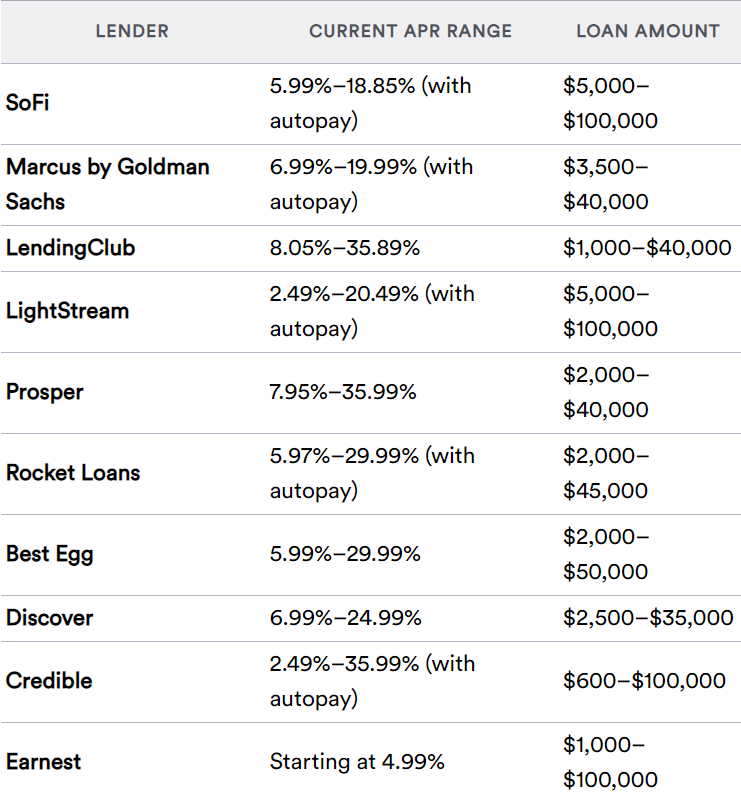

For the ones who have better credit history, numbers are the following:

Wrapping Up

We hope that our article helped you to understand crypto loans better and why they might be the next big thing on the market. Crypto loan is a relatively new crypto product thus has a long way to go. As for us, we will be watching the crypto lending market grow and inform you about its development. Stay tuned!