CoinLoan Crypto-Lending Platform Lists Binance USD (BUSD)

We’re proud to announce that USD Binance stablecoin is now available on the CoinLoan platform as a loan asset and collateral asset.

What Is Binance USD?

Binance USD (BUSD) is a stablecoin tied to the US dollar, created in cooperation between Binance exchange and Paxos Trust Company. It’s one of the few stablecoins approved by US regulators. Binance USD’s were issued as ERC-20 tokens, so it is transacted on the Ethereum blockchain network in the same manner as any other ERC-20 token.

As of early April 2020, the Binance USD has been in circulation for seven months. During this period, BUSD has reached a market cap of nearly $200 million, which places it in the 35th position on Coinmarketcap as of April 7, 2020.

The first BUSD use case that comes to mind is applying BUSD to trade crypto. It can also become a hedge against the volatility of your crypto assets. Holding in stable BUSD, you avoid the volatility risks of regular cryptocurrencies. Finally, BUSD can be used as an alternative to fiat currencies.

Where on CoinLoan Did BUSD Appear?

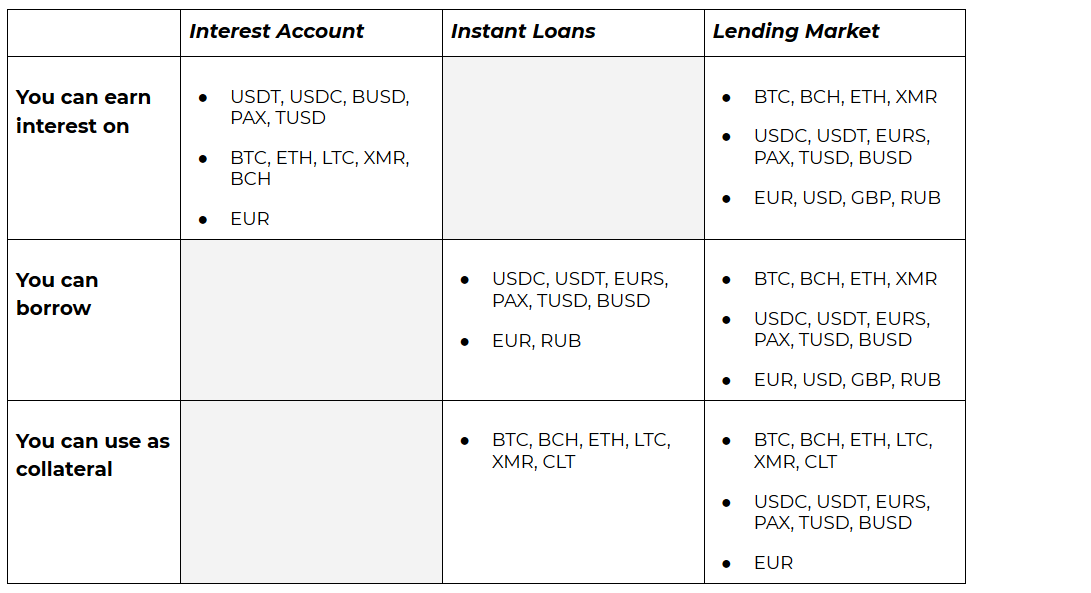

BUSD appeared in all CoinLoan products, along with other stablecoins:

- On Interest Account, deposit BUSD to earn 8% in base mode and 10% when staking CLT.

- On Instant Loans you can get a loan in BUSD.

- On Lending Market, BUSD is available both as a loan currency and collateral.

- On Crypto Exchange, it can be bought and sold in couples with fiat or crypto assets.

There are more and more assets coming to act various roles in different services on CoinLoan. If all this stuff is getting a bit muddy for you, Figure 1 aims to help to figure things out.

How to Get BUSD?

First of all, you can get BUSD on the built-in CoinLoan Crypto Exchange.

BUSD can be purchased on Binance:

- Purchase 1:1 with USD via wire transfer, or top up your Binance fiat wallet with other currencies to exchange to BUSD.

- Convert USDT, USDC, TUSD, and PAX to BUSD.

- Trade on the Binance to exchange other coins to BUSD.

On the Paxos website, you can convert between USD, BUSD, and PAX 1:1 anytime with zero fees.