Bitcoin Trading: Short and Long Strategy With CoinLoan

The market gives equal opportunities for both crypto optimists and skeptics. It's possible to get some profit in the growing market as well as in the falling one. CoinLoan, in turn, offers tools to implement various trading strategies.

With the volatility of the cryptocurrency markets, it’s essential to understand all your options. Consider you see a bright future for Bitcoin and believe that altcoins are a waste of time. Then you could bet against the altcoins while investing in Bitcoin. If you are right, you just won that much more.

At the same time, holding both long and short positions on different (but similar) assets diversifies a portfolio and helps to reduce overall risk. For example, different cryptoassets often move on parallel tracks. Going long on Bitcoin and short on Monero could potentially protect your crypto portfolio from market moves that affect the entire crypto ecosystem.

From this fundamental perspective, we will describe how betting for and against asset works and how CoinLoan tools can benefit those strategies. By the way, CoinLoan has recently added crypto loans backed by fiat or stablecoins that work perfectly for short selling.

Thus spoke the Master Trader:

"Without the wind, the grass does not move. Without knowledge any tool is useless."

Appropriate tools are only half the battle, the other half is understanding of the mechanisms responsible for crypto trading. Let’s unpack them a bit.

Rising and Falling: the Endless Cycle

Everything changes permanently. Change is a universal law of nature. Markets are subject to this law, too, so beware: after the fall will come the rise, and after the rise will come the fall.

Climbing up a peak takes time and effort and is usually a slower process. Price falls due to fear and panic, so falling usually happens faster. Ask yourself: what the price is doing right now and where it comes in just a moment later? Your accurate prediction can bring you some benefit.

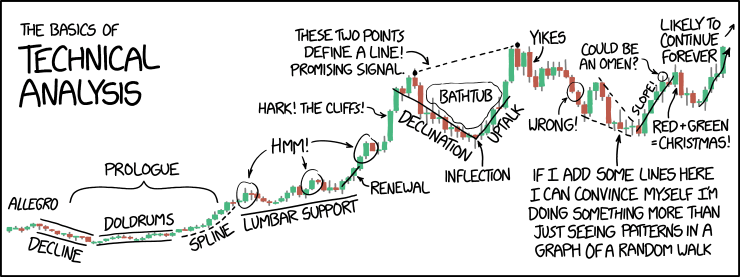

In the next paragraph, we’ll explore two opposing trading strategies that complement green and red candles on the chart.

Your Yin Is Going Short

When investing, you can bet against an asset. The concept is called short selling. It means a bet that a crypto's price will fall over time. Shorting originates from securities, but the strategy applies to cryptocurrencies as well.

Thus spoke the Master Trader:

"Never go short when the price is falling too strong: it will rise again soon!"

Consider you believe bitcoin is going to crash any day now. You borrow 1 BTC from a friend and sell it at once. Thus you owe your lender 1 BTC. A few days later, the bitcoin market goes down. You repurchase 1 BTC at a new price and pay back the debt. You just “sold it short” and profited the difference.

In practice, you would most likely struggle to find a friend who borrows bitcoins and agrees to receive the same amount back. There comes a time for CoinLoan and its borrowing feature. Imagine you deposit 10,000 USDT to borrow 1 BTC on Lending Market. Selling that bitcoin at market price will earn you about 6,400 USDT at the moment of writing. If the price drops to 3,000, you repurchase 1 BTC to repay your loan, get 10,000 USDT back and pocket the 3,400 USDT difference minus interest you pay.

Your Yang Is Going Long

Going long means buying with the hope that your asset will increase in price. Despite the name, it doesn’t necessarily mean that you’ll be holding the asset for a long time. Day traders “go long” when they buy some coins and sell them for a higher price an hour later.

Thus spoke the Master Trader:

"Never go long when the price is growing too much: it will fall much stronger soon!"

The first step here is to purchase and keep a promising asset. The second step is to make your money a little (or not so little) extra by selling it as soon as candlesticks on the chart turn green.

Playing long, you’ll often need to sell a part of portfolio to free up capital and buy new coins. If you don't want to sell your portfolio in a hurry, CoinLoan Instant Loans come to the rescue.

Consider you hold 1 BTC and want to make some money on the upcoming rise. Cashing out sounds too easy for you, so you prefer to take a loan of 5,000 USDT against your 1 BTC to buy some new bitcoin. If your prediction is correct and BTC price climbs, you may decide to fix a profit. You can sell your new Bitcoin for 6,000 USDT, for instance, and repay 5,000 USDT you’ve borrowed. Your net profit is $1,000, minus the interest you pay for a loan. This is the desired result when going long.

Disclaimer: This article is not intended to be a source of investment, financial, technical, tax, or legal advice. Please remember that trading is a high-risk activity.